Global Fashion Summit: Circularity highlights

Global Fashion Summit 2025 spotlighted circularity, diving into everything from upcycling and repair to innovations in textile-to-textile recycling. Here are some highlights from the conference.

This is a special feature post in Circular Fashion News. In addition to weekly news recaps, the publication also shares occasional deep dives and special stories across the circular fashion space.

Last week, the Global Fashion Agenda held its annual Global Fashion Summit. This year’s theme, “Barriers and Bridges,” captured the tension the industry is facing: the need to innovate and adapt while navigating an increasingly complex regulatory landscape.

Circularity was a key focus across many sessions. Discussions centered on how to scale circular solutions and engage customers in the process.

The evolving role of resale was explored through the lens of technology. Upcycling took the spotlight in a session reimagining future products, while clothing repair was discussed in the context of increasing demand for circular products and business models. The future of circular fibers was discussed from several angles: textile-to-textile recycling, biobased alternatives, and regenerative practices. Also, reimagining craftsmanship and designing products with circularity in mind were recurring themes throughout the program.

Other topics included the shifting raw material landscape, upcoming regulations, the rising need for data compliance, and the growing impact of AI on fashion supply chains.

Below are a few highlights from the week through the lens of circularity, including key takeaways, company spotlights, news announcements, and useful resources mentioned in the sessions.

The two-day program featured a range of fascinating conversations between industry professionals. Below are highlights and insights across four key themes: 1) Upcycling, 2) Repair, 3) Material Innovations, and 4) Regulation Landscape.

Upcycling: Industry’s first-movers are doing it locally

Upcycling took center stage in a session reimagining future product realities. The conversation explored how pioneering brands are working with used textiles and what today’s upcycling culture looks like. Speakers represented a wide spectrum of the industry, from a global brand to a small independent label and a non-profit organization. Despite their differences, one approach was shared: local execution.

The Revival, a community-led initiative based in Ghana, tackles textile waste by collecting discarded secondhand clothing and upcycling them through local collaboration. They work with craftsmen from the Kantamanto market and fashion students to transform these garments into new pieces.

A local-first model was also visible in other examples. Norwegian outdoor brand Norrøna runs 13 repair centers, fixing around 24,000 products annually. Items that can’t be repaired are upcycled through a collaboration with a Norwegian design company, Recouture.

Even big fashion is piloting localized upcycling. Nike is testing a model where secondhand and deadstock materials are sourced and upcycled by local designers in Paris and London, and sold in local stores within those cities.

Repair: How to scale the industry?

The conversation around fashion repair focused on how to close the supply-demand gap and spark new consumer behaviors that drive demand for circular products.

Paul Kressens, co-founder of United Repair Centre, shared their approach to scaling clothing repair and highlighted key barriers and enablers for the industry. Beyond infrastructure and viable business models, he emphasized the need for a cultural shift: we must start valuing craftsmanship and the art of making and repairing clothes to scale the industry.

He also broke down the main barriers to scaling repair:

Ease of use: The repair process needs to be seamless. The more time-consuming or complicated it is, the less likely customers are to follow through. Ideally, customers should be able to initiate a repair online or in-store, with a simple and intuitive interface.

Cost: Repair is still often perceived as too expensive. Paul pointed out that this changes with scale: when repair volumes grow, unit costs go down, making it more accessible.

Speed: While repairs in few days are difficult to guarantee, United Repair Centre found that a turnaround time under 7 days is fast enough for most customers. In their collaboration with Levi’s, they are piloting a model aiming for 3–4 day repairs.

The conversation also touched on how a garment’s original price influences repair behavior. While almost any item can technically be repaired, most items brought to United Repair Centre originally cost €50 or more.

Material innovations: Recycled, biobased, traceable

The conversation on materials included a wide range of topics from textile-to-textile recycling to emerging biobased alternatives and the need for material traceability.

A session on the future of fibers explored both the barriers and the bridges to scaling material innovations, featuring three industry players: Haelixa (DNA-based traceability), RE&UP (textile-to-textile recycling), and Phycolabs (seaweed-based fiber development).

Patrick Strumpf from Haelixa emphasized the role of traceability in building trust and scaling circular systems. He noted that up to 40% of the organic cotton on the market is not truly organic, and 60% of cashmere is not cashmere, underscoring the need for reliable tracking technologies.

Andreas Dorner from RE&UP shared news of their newly granted Cradle to Cradle certifications. RE&UP uses mechanical recycling to process cotton, polyester, and poly-cotton blends into recycled raw materials. With an annual production capacity of 80,000 tonnes, they are already operating at industrial scale.

Thamires Pontes from Phycolabs, a biotech company developing seaweed-based fibers, spoke about the challenges in building scalable supply chains for biobased materials. She stressed that it’s not just about developing new fibers, it’s about creating the infrastructure to bring them to market. And in this, brand participation is key: without early pilots and adoption, new fibers can’t gain the momentum they need.

Beyond new materials, calls were made for better design. In another conversation, sustainable fashion pioneer Eileen Fisher emphasized that we can’t simply “recycle our way out of this mess.” Thoughtful design is essential to prevent waste in the first place.

EU Regulations: What is currently happening?

Jessika Roswall from the European Commission gave a keynote summarizing key legislative developments affecting the fashion industry. She emphasized the importance of industry involvement in shaping effective regulation and urged fashion professionals to actively share feedback.

Here are the highlights of current and upcoming EU legislation:

The Ecodesign Working Plan has been adopted, with textiles listed as a priority.

Goal: Make products more circular, energy- and water-efficient, easier to reuse, repair, and recycle. Improve information flow across the value chain and increase the use of recycled materials.

The Digital Product Passport (DPP) is moving forward as planned.

Goal: Provide recyclers, consumers, and other stakeholders with key product information, such as where a product was made, what it's made of, and how to handle it after use.

Negotiations have concluded on Extended Producer Responsibility (EPR) for textiles.

Goal: Drive better design and waste reduction through financial incentives. Introduce fees to discourage fast fashion and reward sustainable practices.

The EU is exploring ways to regulate ultra-fast fashion imports, leveraging existing frameworks like the Digital Services Act and Digital Markets Act.

Goal: Level the playing field, ensure compliance, strengthen consumer protection, and support businesses investing in sustainable practices.

A Circular Economy Act for textiles is expected in 2026.

Goal: Unlock the business case for circular models, create a functioning market for textile waste and circular products, and increase the share of recycled materials used in production.

Here are the major news and launches revealed during the summit that impact the fashion industry’s move towards circularity.

The Ellen MacArthur Foundation released the Remodel program report: The foundation is currently working with brands to figure out ways to scale circular business models. During the Global Fashion Summit week, they released their first program report on how to make the business case for circular business models.

RE&UP celebrated the Cradle-to-Cradle certification of their recycled products: RE&UP’s textile-to-textile recycling materials have received Cradle-to-Cradle certification.

Refiberd was announced as the winner of Trailblazer Programme 2025: Refiberd is developing a textile detection system using hyperspectral imaging and AI. They were announced as the winner of the Global Fashion Agenda’s Trailblazer Programme 2025. Earlier this year, Refiberd also won the CFDA x Ebay Circular Fashion Fund award.

SOLK launched their bio-circular sneakers: Sneaker brand SOLK revealed their sneaker that is made with a bio-circular focus. At the end of their life, SOLK sneakers can be sent back to the brand, where they are composted in batches.

World Business Council released Circular Transition Indicators (CTI) sector guidance for the fashion industry: WBSCDS released a guide for textile and fashion companies to measure how circular they are, how they can improve circularity, and how those improvements impact business and sustainability goals.

In the summit’s Innovation Forum, a bunch of interesting solutions for the industry were highlighted. Here are some highlights that are interesting for the fashion industry’s circularity.

Textile traceability: Haelixa – Haelixa is creating a traceability DNA-based solution for the textile industry, which allows brands to verify material authenticity and track product origins. The non-toxic DNA marking is applied to the raw material via a simple spray process.

Fashion resale: Authentified – Authentified is building a plug-and-play solution for fashion resale, enabling customers to easily resell items with automated listings and pricing, while giving brands visibility into what products are resold and by whom.

Excess inventory management: Musthad – Musthad’s platform helps brands to manage their excess inventory through a global ecosystem of 100+ circular operators specializing in extending the lifetime of excess textiles through resale, reuse, repurposing, and recycling.

Circularity platform: Tern – Tern is building a platform for brands through which they can offer a wide selection of circularity services for their customers, including buyback and takeback solutions, resale, reuse, and repair.

Fashion resale: VNYX – VNYX is solving the profitability problem in fashion resale through AI robots that automatically measure and photograph the product, as well as create the product information.

DPP solution: Madeby Circular – Madeby Circular is building a Digital Product Passport solution for fashion brands, enabling them to track product history and support circularity programs such as take-back, resale, and repair.

On-demand manufacturing: Manny AI – MannyAI is using AI for agile, on-demand manufacturing. It connects brands, factories, and mills in real‑time, allocating orders based on live fabric, capacity, and supplier data.

Textile recycling: Resortecs – Resortecs enables large-scale textile recycling by making garments easy to take apart. Using heat-dissolvable threads and Smart Disassembly™ technology, they help brands design for circularity and recover more materials.

Circular textile materials: OceanSafe – OceanSafe is a Swiss material science company developing biodegradable, circular alternatives to synthetic textiles.

Biodegradable dyes: Newera Bio – Newera Bio is developing high-performance, biodegradable textile dyes. Their plant- and microbe‑based colourants integrate seamlessly into existing dyeing processes, allowing quick scaling.

Biomaterials: Phycolabs – Phycolabs is a biotech company that has developed a fiber from seaweed.

Biomaterials: AMSilk – AMSilk is a German biotech company creating high-performance, biodegradable silk-like materials. Their Biosteel® fibers are recyclable and microplastic‑free.

Biobased alternative to polyurethane: Matereal – Matereal is a materials startup using chemistry and AI to create plastic alternatives. Its flagship innovation, Polaris™, is a non-toxic, biobased polyurethane substitute used in textiles and footwear.

Throughout the program, the speakers dropped and referred to resources and reports that their organizations had launched lately. Here is a list of some of the resources I bookmarked during the conference.

Legislation tracker in the EU and the US: HeyFashion – HeyFashion is a platform dedicated to elevating the issue of textile waste in the fashion industry, founded by The Eileen Fisher Foundation and Pentatonic® in 2022. The site features “Legislation Tracker”, which reports on the state of the EU and the US legislations related to textiles.

Reports on the luxury industry: Positive Luxury – Positive Luxury provides consultancy and certifications to luxury brands. They release reports on the luxury industry as well as precise sustainability topics.

Scaling next-gen materials: Fashion For Good report – Fashion For Good released a report on the scaling of next-gen materials earlier this year. Based on industry best practices and the successes of early movers, the report provides brands with a structured framework to act on key levers and a pathway to address key challenges while driving measurable results.

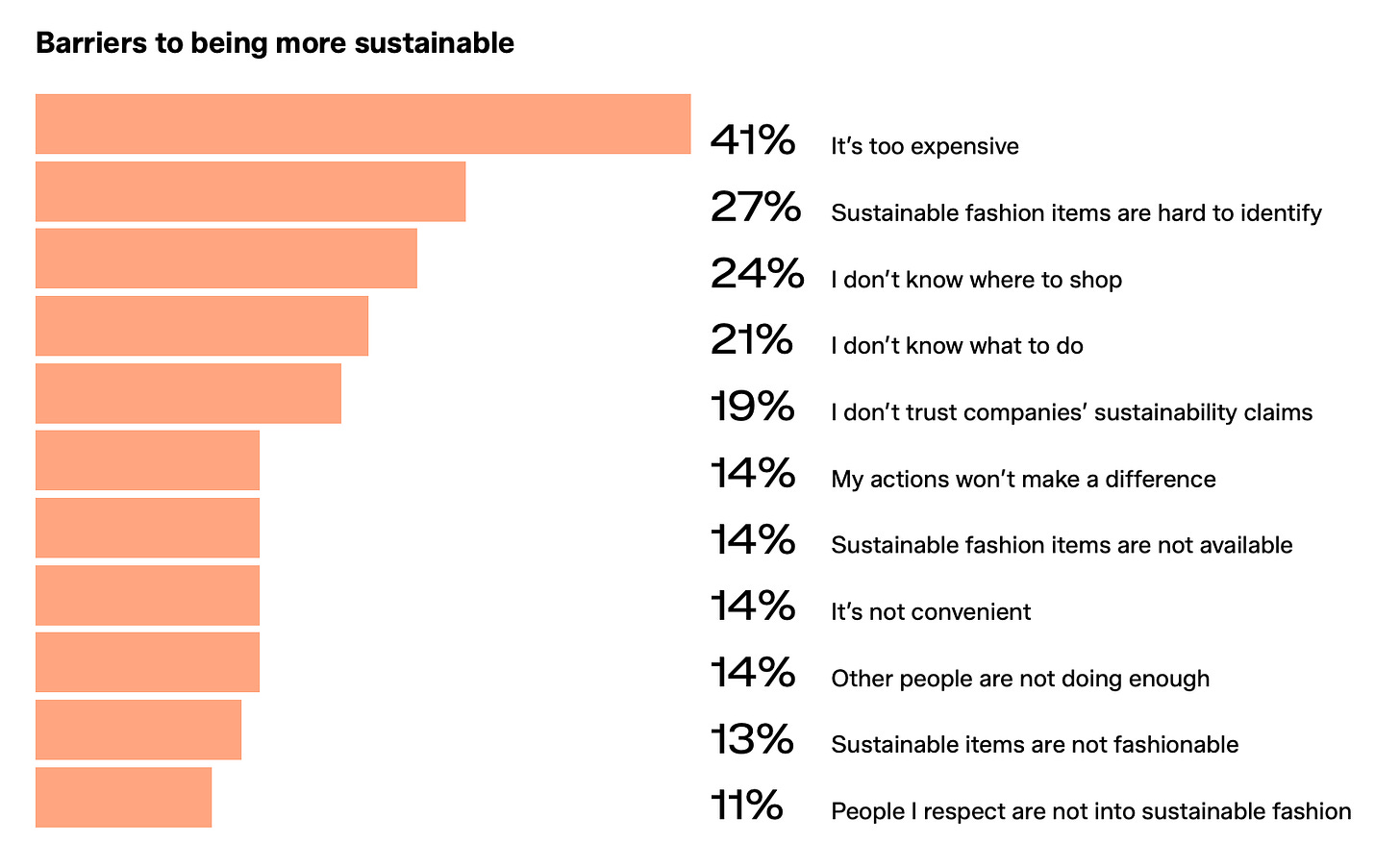

Sustainability attitude-behaviour gap: Zalando’s report – Zalando has published an updated report on the consumers’ attitude-behaviour gap in sustainability. The report identifies what’s preventing consumers from making more sustainable fashion choices and what’s needed to bridge the gap.

Measuring and improving circularity: CTI guidance by WBCSD – The World Business Council released Circular Transition Indicators (CTI) sector guidance for the fashion industry last week. This tool helps brands to measure how circular they are, how they can improve circularity, and how those improvements impact business and sustainability goals.

Thank you so much for sharing this! Some very cool innovations going on in the circular fashion space, but we have way more work to do in shifting consumer mindset