Circular Fashion News / Q1, 2025

What has recently happened in circular fashion space? A recap on the events and news that have been monumental in the space of circular fashion during the first quarter of 2025.

The newsletter has been on a little break, but now we’re back!

This week, we’ll take a look at the significant events and news that have impacted the circular fashion space during the first quarter of 2025.

From now on, you will also be able to listen circular fashion news in a podcast format. Listen this episode here.

Some of the events and highlights from Q1 have included:

The EU has come to an agreement about Extended Producer Responsibility (EPR) for textiles, marking a significant step in regulating textile waste

A devastating fire at Ghana’s Kantamanto market, the world’s largest secondhand market, destroyed 60% of its infrastructure

A new standardized method has been developed to calculate how often buying, renting, or repairing an item through a circular business model replaces the purchase of a new item

The resale market continues to grow, with a projected 13% growth for 2025

Nuuly has become the first major fashion rental business to reach profitability, signaling a shift in the rental market’s viability

Leading textile-to-textile recyclers have formed a T2T Alliance, aiming to influence EU policies and reshape industry perspectives on textile recycling

EU regulations: Agreement on EPR, reporting on unsold stock, mandatory textile collection

EU agreed on implementing Extended Producer Responsibility (EPR) for textiles

The EU has agreed to implement Extended Producer Responsibility (EPR) for textiles, which will require fashion brands to pay up to €0.12 per clothing item to fund end-of-life recycling.

In February, the European Parliament and Council reached an agreement on revising the Waste Framework Directive. This revision includes the introduction of an EPR framework for textiles, making fashion brands responsible for the waste generated by their products.

What does this mean in practice?

Fashion brands and textile producers will be required to pay up to €0.12 per clothing item to support waste collection and recycling efforts. The exact fee will depend on how circular and sustainable the product design is.

Although the agreement has been made, the directive change must still be officially approved by all parties before it can be implemented.

2025 enforced regulations: Starting this year, large companies must report on the destruction of unsold stock

In July 2024, the EU Ecodesign for Sustainable Products Regulation (ESPR) officially came into force, and this year marks the beginning of its implementation.

One of its key measures targets the destruction of unsold stock. Starting in 2025, large companies will be required to report how much of their unsold stock they destroy. By 2026, the destruction of unsold stock will be banned altogether.

This is a crucial step in addressing the rampant overproduction of fashion items, highlighting that transparency is the first step toward accountability.

—> Read more about the problem of unsold stock in fashion

—> Read more about the destruction of unsold textiles in the EU

2025 enforced regulations: Textile collection became mandatory for all EU member states

As part of the Waste Framework Directive, it became mandatory for all EU member states to implement textile waste collection starting this year.

This regulation plays a pivotal role in advancing the circular fashion economy across the EU.

—> Read more about textile collection in the EU

State of the industry: Questions about the industry’s economic promise, silence on Kantamanto market fire, H&M Foundation’s €1.5M circular investment

New study questions circular fashion’s promised economic and environmental gains - highlighting the need for systemic change

A new peer-reviewed study, published in Frontiers, takes a critical look at circular fashion’s promised $500 billion economic opportunity and its broader environmental benefits.

One of the key findings challenges the dual promise of profitability and sustainability of circular business models: “If circular business models successfully reduce new production, fashion revenues will shrink, contradicting circular fashion’s economic promises. If they merely supplement new production, environmental benefits will be negligible.”

—> Read more about the topic

—> Read the full study

Devastating fire at Ghana’s Kantamanto market: how did the fashion industry respond?

On January 1, a devastating fire took place at Ghana’s Kantamanto market, the world’s biggest secondhand market, destroying approximately 60% of the market and devastating the livelihoods of nearly 10,000 people. Hundreds were injured, and two community members lost their lives.

Kantamanto market is a vital hub in the circular fashion space, recirculating as much as 25 million clothing pieces from the Global North per month.

In response to the fire, the local non-profit The Or Foundation launched a relief fund to support affected community members and rebuild the market. The fashion community has been urged to contribute, yet so far, it has been silent from the side of fashion brands. Vestiaire Collective is one of the only fashion companies in the Global North to publicly recognize the disaster, make a donation, and call on others to do the same.

—> Read the latest report from The Or Foundation in rebuilding efforts

—> Read Guardian’s latest article about the aftermath of the fire

H&M Foundation to commit €1.5 million to “The Fashion Remodel” by Ellen McArthur Foundation to scale circular business models

The H&M Foundation has pledged €1.5 million to support The Fashion ReModel, an initiative by the Ellen MacArthur Foundation aimed at redefining how fashion brands generate revenue without producing more clothes.

The participating brands include Arc'teryx, H&M Group, Reformation, Primark, and Zalando, and the goal is to accelerate the adoption of circular business models such as rental, repair, and resale. Over the next three years, participating brands will work to increase the share of their revenue coming from these models and report their progress annually.

—> Read more about H&M Foundation’s involvement

—> Read more about The Fashion Remodel

Fashion resale: 65% of resale purchases replace new ones, resale continues to grow, Vinted targets Vestiaire’s market

New standardized method reveals displacement rates in circular business: 65% of resale purchases replace new ones

WRAP has developed a standardized methodology to help circular businesses calculate displacement rates - the rate at which buying, renting, or repairing an item through a circular business model replaces the purchase of a new item.

The methodology was tested with case study partners Vestiaire Collective, eBay, and Depop, revealing that 64.6% of second-hand clothing purchases replace the purchase of a new item.

The methodology was also tested in the repair sector, with case study partners SOJO, The Seam, and Finisterre. In this context, an impressive 82.2% of clothing repairs replaced the need to buy new items.

—> Read more about the methodology

Resale continues on a growth trajectory - but US tariffs bring mixed consequences

In 2024, the global secondhand market expanded by 15%. While the traditional fashion industry is projected to see sluggish single-digit growth in 2025, according to The State of Fashion 2025 report, the resale fashion sector is expected to maintain its strong upward trajectory. The newly released ThredUp Resale Report estimates a growth rate of approximately 13% for resale fashion in 2025.

In previous years, recession fears and inflation drove fashion resale growth. This year, ThredUp predicts tariffs from the Trump administration will have a similar effect. According to their report, 60% of consumers expect higher apparel prices and plan to turn to secondhand, while 80% of retailers anticipate business disruptions, with 54% viewing resale as a more stable option amid tariff uncertainty.

However, tariffs can also impact the resale industry negatively. According to Vogue, tariffs on China, in particular, could drive up luxury resale prices. China plays a crucial role in authenticating and restoring luxury resale items, while some resale platforms depend on Chinese hubs for logistics or source their inventory from Asia. As a result, luxury resale prices may see an increase.

—> Read the ThredUp Resale Report 2025

—> Read Vogue’s analysis of tariffs for China

Vinted making moves to get their part of the luxury fashion secondhand market

Vinted seems to be stepping up its game in the luxury secondhand fashion market - most likely aiming to gain market share from Vestiaire Collective, Europe’s biggest resale site for luxury fashion.

In 2023, the platform introduced an item verification program which is an essential feature for buyers of high-end fashion. Vinted’s verification process closely mirrors the one offered by Vestiaire Collective. Last year, they also released data for the first time on luxury fashion items sold and liked on the platform.

Now, they appear to be ramping up their marketing efforts, starting with a "House of Vinted" pop-up in London, where invited users can shop secondhand pieces from brands like Prada, Gucci, and Maison Margiela.

Fashion rental: Nuuly becomes the first major rental business to achieve profitability, peer-to-peer rental having a moment

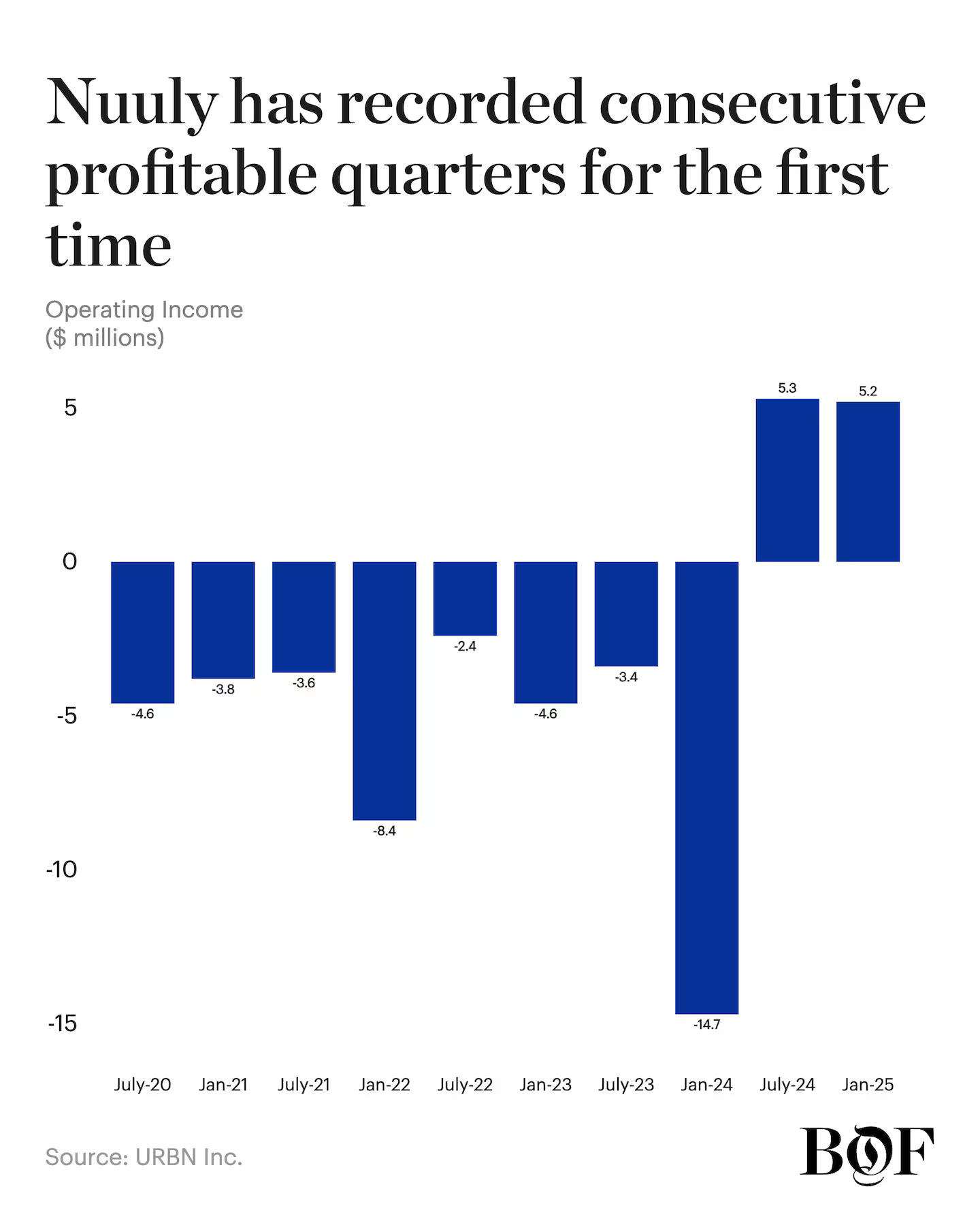

Nuuly becomes the first major rental business to achieve profitability

Nuuly became the first major fashion rental business that achieved profitability - something few in the fashion rental space have managed. In 2024, Nuuly’s full-year sales jumped 60% to $378 million, with an operating income of $13.3 million. The platform has currently over 300,000 active subscribers, more than double Rent the Runway’s 130,000.

A key factor in Nuuly’s success is its deep connection to parent company URBN (Urban Outfitters, Free People, Anthropologie), which invested over $100 million to build the platform in-house. Nuuly has leveraged URBN’s logistics, marketing, and inventory: approximately 50% of Nuuly’s inventory is from URBN brands.

Whereas rental has long been seen as a difficult nut to crack for fashion brands, Nuuly’s success and proof of profitability will hopefully inspire more brands to explore it as a viable and strategic growth opportunity.

Peer-to-peer rental app, Pickle, raises $12M Series A funding

In December 2024, Modern Retail dived deeper into the growth of peer-to-peer rental apps popping up in the industry and gaining significant footing in the market. Currently, there are players like Pickle, Tulerie, By Rotation, My Wardrobe, and Robes Rental in different markets.

—> Read more about Pickle’s newest investment round

—> Read about the P2P fashion rental scene

Fashion repair & upcycling: New app launched in clothing upcycling, more brands integrating clothing repairs

A new fashion upcycling app launched in the UK

The platform aims to make upcycling more accessible and mainstream, offering a seamless way for users to collaborate with skilled designers who can give new life to unwanted garments, turning them into unique, customized pieces.

Fashion upcycling remains a largely untapped space for brands and businesses, making Loom one of the pioneers in the industry. Other interesting solutions in the market include Della Yellow and Fixing Fashion (a project by a non-profit One Army). These platforms provide tutorials on repairing clothing as well as creative guides for upcycling clothes.

Growing interest from brands towards clothing repair: SOJO and United Repair Centre partnerships

The interest from brands in implementing clothing repair solutions continues. This year has already seen notable partnerships between repair service providers and major fashion brands.

SOJO, a UK-based clothing repair service, recently partnered with H&M Group’s Arket to offer repair services in the UK. Earlier this year, SOJO also teamed up with British heritage brand Paul Smith to provide clothing repairs and alterations for them.

Meanwhile, United Repair Centre, which operates in the Netherlands and the UK, has announced a new partnership with Gore-Tex. This collaboration gives customers direct access to repairs for their Gore-Tex items.

Fashion Recycling: Leading textile-to-textile recyclers form an alliance, Spinnova undergoing significant changes, advancements in automatic sorting of textile fibers

Leading textile-to-textile recyclers have formed a T2T Alliance to impact EU policies and general perspectives

Leading textile-to-textile recyclers, Circ, Circulose, RE&UP, and Syre, have formed an alliance to impact EU policies and general perspectives around textile recycling. The alliance’s commitments lie in:

Advocating for textile-to-textile recyclers’ perspective in EU legislation and policies.

Supporting the development of new legal requirements mandating textile-to-textile recycled content and recyclability in new textile products in the context of the Ecodesign for Sustainable Products Regulation (ESPR).

Removing barriers that hinder the growth and scalability of the textile-to-textile recycling industry.

—> Read more about the alliance

Spinnova undergoing significant changes: Stock decline, Suzano collaboration ends, CEO resigns

Spinnova, a Finnish company specializing in the development of textile fibers from wood pulp and waste materials, has faced some drastic changes recently.

In February, Spinnova announced that Suzano, a Brazilian wood pulp producer and joint venture partner in Woodspin, decided not to proceed with further investments in their collaboration. This decision was attributed to Suzano's revised priorities and capital allocation strategy, rather than doubts about Spinnova's technology. Yet, the development led to a significant drop in Spinnova's stock value, with shares losing approximately half of their value following the announcement. A few weeks later, Spinnova's CEO, Tuomas Oijala, submitted his resignation.

In light of these events, Spinnova has embarked on a comprehensive strategic assessment, reviewing all joint ventures and planning future actions.

New database boosts automated textile recycling

The U.S. National Institute of Standards and Technology (NIST) has launched NIR-SORT, a free database designed to improve the sorting of textile waste for recycling. It contains near-infrared (NIR) spectral data for 64 fabric types, including common fibers like cotton and polyester, as well as blend materials.

Why does this matter?

Sorting textiles is a major challenge in recycling. Labels are often missing or incorrect, making it hard to separate materials properly. Near-infrared technology can "read" fabric compositions by analyzing how they interact with light, helping machines quickly and accurately identify fibers. This database is a key step toward automated sorting, making textile recycling more efficient and reducing the amount of clothing sent to landfills.

—> Read more about the database

Did I miss some important event or news in the space of circular fashion? Let’s continue the discussion in the comments 👉