Circular Fashion News / May 15: Vinted's growth, ThredUp's new moves in RaaS, eBay's Trend Report

Your weekly edit of what has happened in the circular fashion space. This week, the focus is on resale: Vinted's record-breaking financial results, ThredUp's new moves, and eBay's new trend report.

I took a little unexpected break, but now we're back! This week’s recap covers key news from the circular fashion space over the past two weeks which have included for example:

More brands join the “Fashion Remodel” program by Ellen McArthur Foundation to explore how to scale circular business models

…and launched a venture arm to back the next wave of re-commerce startups in Series B and C

ThredUp removed fees from their Resale-as-a-Service offering

Interest in secondhand fashion is growing among US shoppers: ThredUp reported a significant growth in new buyers, and downloads for resale apps were up in the first quarter of 2025

eBay released Watchlist report, revealing what secondhand fashion shoppers are buying on their platform

A new technology for chemical textile recycling was developed: removing and capturing textile dyes during the process

The RealReal partnered with Supercircle to recycle products unfit for resale

A chemical textile recycling startup, Eeden, raised €18 million in funding to support the construction of their demonstration plant

Industry News

The “Fashion Remodel” is a project by the Ellen McArthur Foundation, aiming to find ways for fashion brands to scale circular business models and decouple revenue from resource extraction.

Previously this year, brands such as Arc’Teryx, H&M Group, and Primark joined the project. Now, more brands have joined, including Decathlon, eBay, Tapestry, and John Lewis.

—> Read more about the “Fashion Remodel”

Fashion Resale

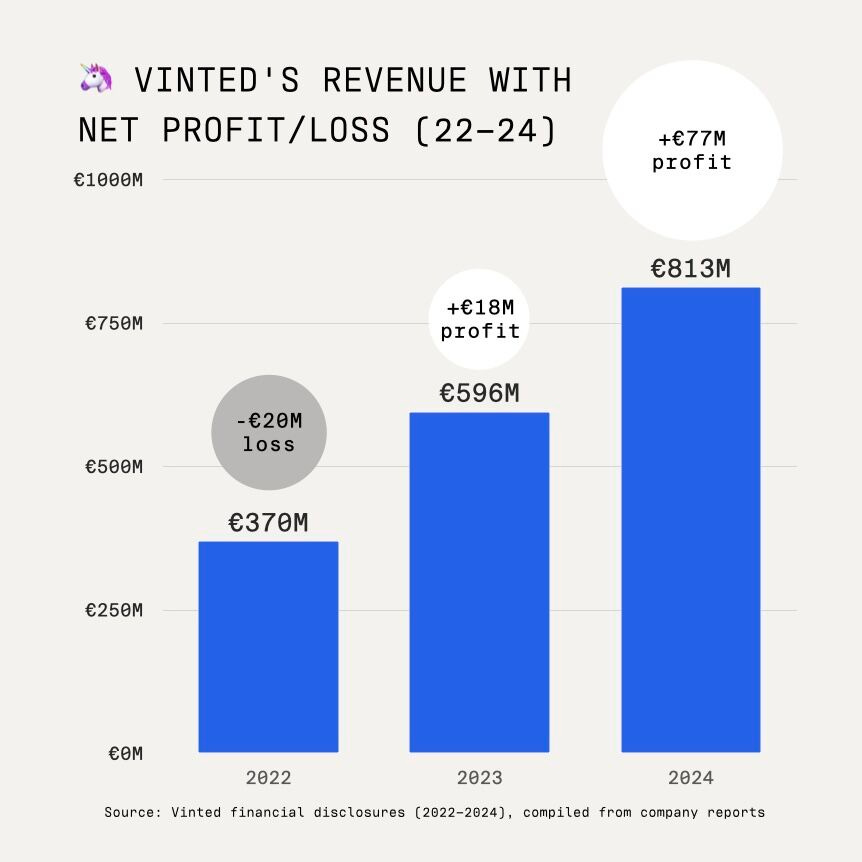

Vinted reported record-breaking financial results for 2024: their revenue grew to over €800 million (2023: €596.3 million), and net profit soared to nearly €77 million (2023: €17.8 million). Whereas in 2022, Vinted was still turning a net loss, the growth to €77 million in net profit in 2024 is impressive.

The group’s CEO appoints this success in profitability and revenue growth to “relentless focus on cost control, building complex infrastructure ourselves, and innovating to bring new services and solutions at scale”.

Rian Marais from Lyst wrote an in-depth analysis of Vinted’s growth —> access it here.

In addition to announcing record-breaking financial results, Vinted Group has launched Vinted Ventures, a new investment arm aimed at fueling “the next generation of startups to accelerate re-commerce and reshape consumer behaviours in favour of second-hand”.

Vinted Ventures will target companies at Series A to C stages, with investment tickets ranging from €0.5 million to €10 million. Its focus is on bold visions and data-driven solutions that advance the re-commerce ecosystem.

What kind of companies are re-commerce startups in the Series A-C phases?

Re-commerce startups raising Series A, B, or C funding rounds are typically in their growth and scaling phases. Before reaching these stages, they may have raised angel, pre-seed, and/or seed funding to build and validate their product.

By Series A, they have proven product-market fit and are focused on scaling operations and growing their team. A recent example of a re-commerce startup in the fashion space is Pickle, a US-based peer-to-peer rental platform, which raised its Series A round recently. With this latest funding, Pickle plans to enhance its product offering and expand into new markets across the United States. Series B and C typically fuels further expansion and market growth, international expansion, or even preparation for acquisition or IPO.

ThredUp announced to be removing fees from their Resale-as-a-Service model offered for fashion brands. With the move, they aim to make resale more accessible to more brands. This is definitely a bold move in the space of branded resale where competitors in the US market include for example Trove, Treet, Archive, and Recurate.

In addition to announcing fee removal, they announced also other enhancement to their service. One of these enhancements was that brands will earn additional revenue share on items sold from ThredUp's existing inventory within their branded shop, in addition to revenue generated from their own inventory. In addition, ThredUp announced to be launching peer-to-peer component to their branded resale offering later this year.

Resale platforms in the US have seen a growth in new shoppers during the first quarter of 2025, which has been driven by the US tariff landscape according to Business of Fashion.

ThredUp reported that the number of new buyers in the first quarter of 2025 grew 95% compared to last year, marking the largest quarterly increase in new customers in the company’s history.

The RealReal reported an 11% year-over-year increase in its first quarter revenue.

And according to data from Sensor Tower, the downloads of resale apps in the US rose during the first quarter of 2025, with Depop and Vestiaire Collective among the ones seeing the most significant growth.

eBay's newly launched Watchlist Report offers fascinating insights into shopping trends in the secondhand fashion market. Today, nearly 40% of all clothes and accessories sold on eBay are categorized as "pre-loved." In 2024, the term "vintage" was searched 1,200 times per minute on the platform.

The report reveals the fastest-growing brands in the pre-loved section on eBay, with Birkenstock, Altuzarra, and Tombolo leading the charge. When it comes to luxury, Louis Vuitton and Armani dominated the most-sold lists, with Louis Vuitton topping the charts in both the US and Germany, and Armani leading in the UK and Italy.

—> Read more here

—> Read the full report

Editor’s note:

As resale fashion continues to grow, so does the volume of reports focused on what’s selling and what holds value. In the last few weeks alone, Vestiaire Collective released its Resale Buying Guide spotlighting key brands and products holding value, while Third shared its Third Find Investment Report, focusing on luxury bags that maintain their worth. The RealReal continues to publish its annual luxury resale trend report, and Rebag similarly releases yearly insights into luxury accessories' resale market.

It seems like the quarterly or annual trend report is quickly becoming a standard for resale fashion platforms. But here’s a thought: what if we had access to a constantly updated database of resale fashion trends? Think Spotify Trending or Substack Rising, but for the resale market: highlighting pieces with highest resale value, or data about what are people searching right now on resale platforms.

I see this as a natural step forward from the trend reports, but which platform will be the first to bring this innovation to life? Whether it’s integrated directly into the shopping process or as a continuously updated database showcasing trending brands and products, the idea of live resale trend tracking could make waves in the resale space.

Thredup collaborates with (Re)vive - ThredUp announced a collaboration with a fashion returns and deadstock management platform, (Re)vive. Through this partnership, the returned and deadstock items from brands are repaired and cleaned by (Re)vive, and sold through ThredUp’s resale network.

Vestiaire Collective continues on celebrity closet sales, this time featuring Rosie Huntington-Whiteley - Vestiaire Collective has launched a celebrity closet sale together with Rosie Huntington-Whiteley. This continues in the footsteps of earlier celebrity closet sales Vestiaire Collective has done together with Paris Hilton, Jessica Chastain, Laura Dern, and Chloe Fineman. Read more about the celebrity close sale trend here.

ThredUp collaborates with Beyond Retro for a vintage drop - ThredUp is launching an online vintage fashion drop together with the UK-based vintage retailer, Beyond Retro. The collection will feature more than 20,000 handpicked vintage and vintage-inspired apparel items.

A luxury pre-loved fashion retailer, Luxe Collective, shuts down - UK-based luxury secondhand retailer, Luxe Collective, has announced to be shutting down. The company revealed the news on its social media after major struggles. Last year, Luxe Collective faced a major robbery, where over £500k in stock was stolen, representing 50% of Luxe Collective’s inventory.

Textile Recycling

A new technology has been developed by a researcher Yiqi Yang at the University of Nebraska for chemical recycling of textiles. This technology successfully removes textile dyes, as well as separates natural and synthetic fiber blends.

According to Yang, together with his team, they’ve developed a way to remove the dyes used in textiles without damaging the dyes or the fiber polymers: this allows for the reuse of textile fibers as well as the dyes.

Resale platform The RealReal has partnered with Supercircle, an end-of-life recycling partner for fashion brands. Through the partnership, The RealReal aims to recycle its damaged, counterfeit, and unmarketable inventory via fiber-to-fiber recycling or downcycling.

What is Supercircle?

SuperCircle is a technology and reverse logistics platform that enables fashion brands to manage the end-of-life of their products. It provides a solution for collecting garments at the end of their life, sorting them by material type, and directing them to appropriate recycling partners. In addition, SuperCircle offers brands data and insights into where and how their products are processed.

—> Read more here

—> Read more about Supercircle

A chemical textile recycling startup, Eeden, has raised €18 million in Series A funding to support the construction of a demonstration plant for its textile-to-textile recycling process.

Eeden recycles textiles made from cotton, polyester, and cotton-polyester blends. Using its technology, the company breaks down discarded textiles into their core components, cellulose and polyester, which are then processed by industrial partners into new lyocell, viscose, and polyester fibers.

With this funding, Eeden plans to complete the demonstration plant and open it next year, aiming to validate its technology at scale and demonstrate its ability to deliver cost-efficient, high-performance recycled materials.

DePoly to open a commercial factory in 2027 – Plastic waste recycler DePoly announced a $23 million seed funding, and plans to open a commercial factory for plastic recycling in 2017. The factory is planned to recycle 500 tonnes of PET and polyester waste into virgin-quality raw materials.

Samsara Eco to open a recycling factory in 2028 – Australian biotech company focuses on the infinite recycling of plastic. Last year, they introduced a new technology capable of recycling nylon 6, a synthetic fiber commonly used in the clothing and hosiery industries.

Reju partners with the leading manufacturers of filament yarns in the US and Europe – Textile-to-textile recycler, Reju, announced a partnerships with Utexa and Antex, two global leaders in multifilament yarn production. The companies will be validating Reju’s material, REJU Polyester™, for commercial adoption in multifilament yarns for textile applications.

Hugo Boss launched a new yarn made from recycled polyester – Hugo Boss has introduced a yarn made from recycled polyester, Novapoly, that has been co-developed with the company’s suppliers. The yarn is made from pre- and post-consumer textile waste and is currently exclusive to Hugo Boss, but the company plans to introduce a licensing model in the future to make this fiber available to a broader network of industry partners.

Bookmarked this week

Article: ‘You sold it – now recycle it’: the protesters mailing worn-out clothes to the shops they bought them from by The Guardian – The article highlights a designer and activist Wendy Ward, who started a grassroots movement in the UK urging major retailers to take responsibility for the end-of-life of the clothes they sell. Supporters of the campaign have been mailing their worn-out garments back to brands, demanding they deal with the waste they helped create.

Webinar recording: How to grow resale into a successful business with The North Face, Sandro and Maje by Drapers – This webinar explores how brands can scale resale into a profitable business model. It features insights from The North Face and SMCP (owner of Sandro and Maje) on their resale initiatives, along with input from branded resale platform provider Archive.

Webinar recording: Why recycling won’t save us? by Future Snoops – The first episode in Future Snoops’ Sustainability: No Filter webinar series dives into the limitations of recycling. It explores why recycling hasn’t lived up to its promise, the health impacts of recycled polymers, and how smarter design can help delay the need for recycling altogether.

Textile material innovators database by Donatela Bellone – This database consists of nearly 100 companies innovating in the textile material space, including companies in the biomaterials space as well as new recycled material innovators. The database is created by Donatela Bellone.

Clothing swap company: Cy Swaps – Cy Swaps is a US-based app that lets users exchange clothing items directly with other members of the community. In addition to swapping, the platform also allows users to give away clothes with no expectation of return. A refreshing and community-driven take on reusing clothing!

Secondhand search platform: Secondsense – Secondsense is a startup founded by Chris Lucas, building a search platform for secondhand fashion. The company is currently focusing only on preloved luxury bags, but aims to expand to other categories as well. Chris Lucas was just interviewed by Victoria Smith in Fashion&Founders Podcast, where he shared his founding story.

Secondhand brand: Rita Intimates – A new curated lingerie brand, selection consisting of new and secondhand intimates. The featured secondhand pieces are from past, unsold collections. The brand was recently featured in an article by Fashion United. Such a cool and fresh perspective of mixing new and secondhand pieces in a lingerie collection.

That is all for now, let’s hear again next week! In the meantime, let’s continue the discussion in the comments, LinkedIn, or Instagram <3

xx Tiina