Circular Fashion News / June 3: Emerging circular brands, Blueprint for T2T recycling, Silk-like fiber from recycled cotton

Your weekly edit of what has happened in the circular fashion space. Last week, playbooks were published for scaling circular business models, while emerging circular designers were in the spotlight.

Welcome to reading a weekly recap of circular fashion news! Some of last week’s highlights in the circular fashion industry included:

Visa’s “Recycle the Runway” winners were announced, highlighting multiple emerging designers with circularity focus

Ellen McArthur Foundation released a guide on scaling circular business models

Rreuse called for urgent action to address the EU's textile recycling crisis

The North Face partnered with Prolong to strengthen repair services in the UK

The EU-funded T-REX published a blueprint for textile-to-textile recycling

New silk-like fiber developed from recycled cotton was introduced

Visa Recycle the Runway winners announced

Visa announced the winners of its “Recycle the Runway” competition, an initiative highlighting fashion re-commerce designers and businesses in the UK.

The grand prize went to Genaro Rivas, a fashion designer from Peru focusing on sustainable and inclusive practices. His business model supports small-scale artisanal weavers and incorporates a framework for estimating fair wages in designer-artisan collaborations. All pieces are made-to-order, with circularity embedded from the design stage through careful material choices and styles. The brand also offers a range of after-sales services, including repair, redesign, and resale initiatives.

Other winners included:

Sondor, a jewellery brand using recycled materials

Gbadebo, a fashion label working with recycled and upcycled textiles

Fanfare Label, a fashion label with a focus on upcycled denim

Been, an accessories brand creating repairable and recyclable handbags from recycled materials

Marianava, a brand blending traditional craftsmanship with smart, innovative materials

Ellen MacArthur Foundation released a guide on scaling circular business models in fashion

The Ellen MacArthur Foundation released a three-part guide on how fashion brands can scale circular business models, and why they should do that. The series makes the financial, environmental, and strategic case for shifting away from the take-make-waste model and toward circularity through resale, rental, repair, and remaking.

To make the financial case for circular models, the guide urges brands to adopt new KPIs that capture long-term value. It challenges the reliance on traditional margin comparisons, which often overlook the broader business benefits of circularity (such as stronger customer loyalty, diversified revenue, and reduced exposure to resource risks). While circular models may appear less profitable at first glance, they can drive greater business resilience and long-term return on investment.

→ Read the guide on financial benefits

→ Read the guide on environmental benefits

→ Read the guide on strategic benefits

Rreuse called for urgent action to address the EU's textile recycling crisis

It has become a weekly pattern: textile organisations and NGOs raising the alarm about the deepening crisis in textile reuse and recycling industry. Last week, RREUSE issued a warning ahead of the EU Environment Council meeting.

In an open letter, the organisation urged EU policymakers to add the textile crisis to the meeting agenda and to support the adoption of an EU-wide Textile Emergency Action Plan.

The letter pointed out that, despite the EU’s mandate for separate textile collection starting in January 2025, many Member States are still unprepared. Collection systems are either missing or underfunded, and key financing mechanisms have not been put in place. As a result, social enterprises handling textile flows are under severe pressure: warehouses are full, reuse markets are oversaturated, and increasing volumes of reusable clothing are being sent to incineration.

New report: Price, Quality, and Durability top US fashion consumer priorities

The MMGNET Group released a report on the latest trends shaping the US fashion and retail landscape in 2025. As part of the report, a targeted consumer survey was conducted at the beginning of 2025 for 800 participants.

The report combined the findings from this consumer survey with a synthesis of major industry reports, including McKinsey, Vogue Business, Deloitte, the Financial Times, and Euromonitor. Here are some highlights from the report:

Price, quality, and durability are the dominant factors driving purchasing decisions – Affordability is the top priority for 40% of consumers, followed by quality (35%) and durability (30%). Sustainability concerns remain secondary to price and quality.

Mark-up for sustainability can be 5–10%, but willingness to pay drops beyond that – Most of the respondents are open to modest price increases in exchange for sustainability: 30% say they would be ready to pay up to 5% more, and 28% would accept a 6–10% price increase. Beyond this, the willingness to pay more for sustainability drops significantly. In addition, 28% of consumers are unwilling to pay any extra for sustainability.

13% of US consumers say secondhand is their primary way of shopping – 7% primarily shop through online resale platforms, and 6% through physical secondhand stores.

The North Face partners with Prolong to strengthen UK repair services

The North Face announced a partnership with after-sales technology company, Prolong. The North Face’s existing repairs solution provider is ACS Clothing, and now with the additional partnership with Prolong, they aim to make the post-purchase experience more customer-friendly.

The EU-funded T-REX project released a blueprint for textile-to-textile recycling

The EU-funded T-REX (Textile Recycling Excellence) project has concluded after three years, releasing a comprehensive blueprint for scaling textile-to-textile recycling in Europe. The blueprint maps for example the current state of the industry, identifies key barriers to scale, and provides recommendations for the industry. Here are some highlights from the blueprint:

1. Inefficiencies in pre-processing and sorting

A major barrier identified is the inefficiency of textile pre-processing and sorting. The blueprint stresses the need for further R&D for example in near-infrared (NIR) and AI-based technologies for accurate fiber identification and automated sorting.

2. Limited feedstock availability

The lack of sufficient feedstock, especially post-consumer textiles, is another challenge. Low collection rates across EU member states, combined with weak incentives for sorters to deliver high-quality inputs, contribute to this shortfall.

3. High operational costs

Labour-intensive processes currently drive up costs. The blueprint points to innovation in sorting and pre-processing as a path toward automation, which could significantly reduce costs over time.

4. Energy use and decarbonization needs

Textile-to-textile recycling is energy intensive. The project emphasizes the need to improve energy efficiency and increase the use of low-impact energy sources across recycling processes.

5. Policy and regulatory alignment

Scaling the industry will require regulatory support. The blueprint echoes previous recommendations, calling for harmonized recyclability standards and clearer End-of-Waste (EoW) criteria, both of which influence also Extended Producer Responsibility (EPR) schemes.

In conclusion, the blueprint also stresses that recycling alone is not a silver bullet. While essential for circularity, it must be complemented by upstream solutions such as designing for durability and reducing the environmental impact of production.

→ Read the full blueprint here

→ Read a summary by Fashion For Good here

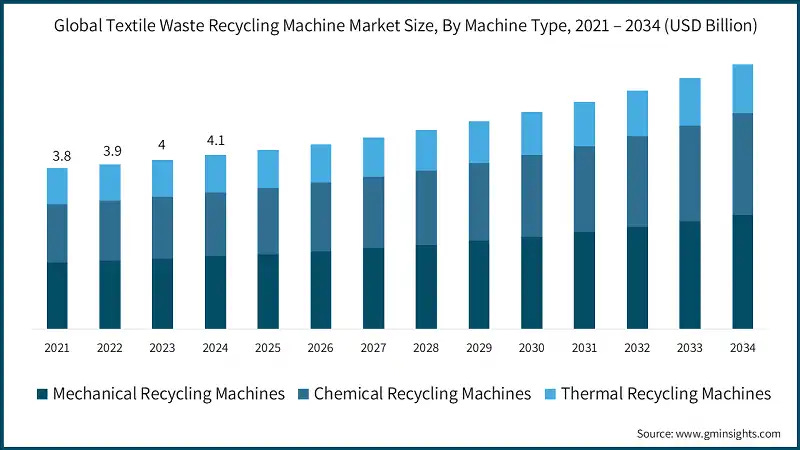

The market for textile waste recycling machines to reach $6.2 billion by 2034

As more and more brands implement recycled fibers into their collections, and more players innovate in the textile-to-textile recycling space, the market for textile recycling machines also grows. GMI Insights published a report on the global market size for textile waste recycling machines. In 2024, the total market was valued at $4.1 billion and estimated to grow to $6.2 billion by 2034. The annual growth rate (CAGR) for the industry is 4.5%.

The market consists of mechanical, chemical, and thermal recycling machines; with mechanical and chemical machines being the ones sold the most. The industry is semi-fragmented with multiple players: some of the biggest ones include Andritz, Autefa Solutions, Dell’Orco & Villani, and Rieter.

New silk-like fiber developed from recycled cotton

HKRITA and Epson have developed a new regenerated cellulose fiber with a silk-like texture, made from recycled cotton waste. The collaboration, launched in 2024, combines HKRITA’s expertise in fiber dissolution with Epson’s dry fiber recycling technology.

In the process, cotton waste is ground and dissolved to form new fiber strands. The resulting material retains the durability of cotton while offering a smooth, silken sheen. Even short cotton fibers, which are often too weak for reuse in apparel, can be recovered and reused through this method.

RE&UP products receive Cradle-to-Cradle certification

Textile-to-textile recycling company RE&UP has received Cradle to Cradle certification for its materials: pre-consumer recycled cotton, post-consumer recycled cotton, and recycled polyester chips. With an annual production capacity of 80,000 tonnes, RE&UP’s materials are already being used in garments by global fashion brands.

Article: How the anti-waste rule in France is creating even more waste by Ali Nishikawa on NSS Magazine – This article builds on an investigation by Disclose, revealing how France’s 2021 anti-waste law may have had unintended consequences. The law bans the destruction of non-food unsold goods and offers brands tax breaks for donating or recycling excess stock. The article and the investigation argue that the law, while well-intentioned, has created a loophole that benefits large corporations financially while ignoring waste issues.

Article: Can reviving local fashion solutions heal Ghana’s textile waste crisis? By AnalystNews – This article explores the complex realities of secondhand fashion imports to places like Ghana’s Kantamanto Market. It sheds light on the challenges faced by local entrepreneurs, as the quality of imported clothing has declined, resulting in 40–60% of the items being discarded. At the same time, it underscores the complexity of proposed solutions, such as outright bans on clothing exports. Beyond the challenges, the article also highlights the vibrant upcycling culture that has emerged in Kantamanto. One example is The Revival, a community-led textile upcycling organization that not only upcycles discarded garments and creates jobs, but also shares expertise through workshops with future fashion students in cities like London and Amsterdam.

Podcast: Circular Materials - Bigger forces at play with Chana Rosenthal and Lutz Walter, The Untangling Circularity Podcast – The concluding episode of “The Untangling Circularity” podcast’s season on circular materials. The discussion explores key challenges such as the trade-offs in price and durability in recycled fibers, and highlights the need for a shift in how we perceive and value the durability of garments.

New upcycling brand: Francine – eBay’s secondhand style director launched her own upcycled fashion brand, Francine. For the first product drop, the brand has partnered with an artist Chiara Perano to hand-paint a series of vintage leather jackets sourced via eBay or from physical vintage/thrift stores. Discover the brand here.

Upcycled brand: Marlène Rougier – This French brand creates upcycled pieces from secondhand clothing and home items. The products are made in a French factory, Losanje, that specializes in upcycled garment production.

That is all for now, let’s hear again next week! In the meantime, let’s continue the discussion in the comments, LinkedIn, or Instagram <3

xx Tiina